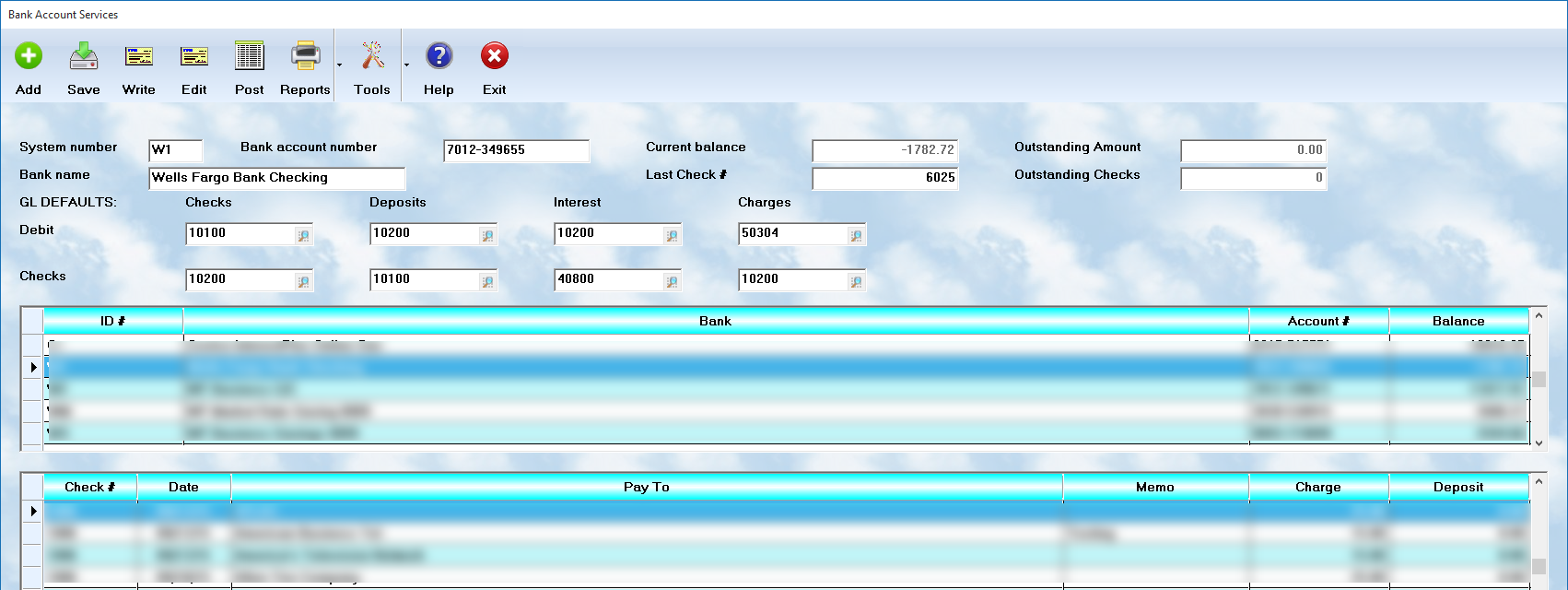

The Bank Accounts

The Accountant supports 1396 active bank accounts by default. It is highly unlikely that anyone will require more than this number. Each account is tracked separately. You may have bank accounts, credit card service bureaus, savings accounts, and certificates of deposit all tracked separately within the system.

Edit Accounts

The system will show a listing of accounts in the browse window, and all of the data in the fields located in the upper half of the window. You can select any account, and edit the data by making changes in the information that is displayed. Be sure to press the Save key when you finish your changes to be sure your information is saved.

Bank Controls

![]() Add To add an account, simply select the Add button and a blank record will be displayed in the screen fields. Be sure to fill in all of the information as appropriate, and select the Save button to save the new data.

Add To add an account, simply select the Add button and a blank record will be displayed in the screen fields. Be sure to fill in all of the information as appropriate, and select the Save button to save the new data.

![]() Save Save any additions or changes

Save Save any additions or changes

![]() Write Write a check from the bank ( rather than through A/P ) See details at Write Checks

Write Write a check from the bank ( rather than through A/P ) See details at Write Checks

![]() Edit - Edit a completed check, deposit, or charge entry. See details at Editing / Reprinting checks

Edit - Edit a completed check, deposit, or charge entry. See details at Editing / Reprinting checks

![]() Post - Post Deposits, Charges, or Interest See details at Posting Deposits / Service charges / Interest

Post - Post Deposits, Charges, or Interest See details at Posting Deposits / Service charges / Interest

![]() Reports - Select and print reports on the bank accounts and balances, plus transactions.

Reports - Select and print reports on the bank accounts and balances, plus transactions.

![]() Tools

Tools

Reprint Reprint the highlighted check

Void Void the highlighted check

Reconcile Confirm which checks have cleared the bank

Close Perform a periodic closing which moves all completed work to history for all accounts

Resum Resum the totals for this checking account to include balance and outstanding amounts.

View History - View a check from history

Format - Select a format for the printed check from available options. See Check formats

Delete Bank - Delete the highlighted bank account. This action is strongly discouraged. It is best to retain this information for audit purposes.

Bank Data

System Number

The System Number is the code assigned to a bank account. It may be comprised of letters and/or numbers. It may be easiest to assign the first two initials of the bank's name, ie. BC for 1st National Bank of Credit, as its code.

Bank Name

Enter the full, formal name of the bank in this field.

Bank Account Number

It is important to use the proper bank account number on this record. This is most easily obtained from your statement, because only some of the numbers at the bottom of your checks actually identify your account. Others are used for the bank identification and check number.

Current Balance

The current balance is the amount you have in the account, based on all checks you have written, even if they have not been reconciled. When first initializing the system, be sure to enter a beginning balance in this field.

Last Check Number

The system will track the check numbers separately for each account. If you wish to start your checks at a special number, enter it in this field, and the system will advance from this point. Debit G/L When checks are written, they are usually for expenses. If one bank is usually used to write checks for a specific expense, ie. payroll, or parts, it may be possible to enter a General Ledger account number for the default Debit value, which corresponds to the banks actual G/L number. Place it in this field.

Outstanding Amount

The system will total the amount of checks that have not yet been reconciled. This does not mean they are not canceled. Most banks only return checks once per month. Therefore, the amount represented here only specifies the amount at the last statement. Please remember that this amount has been used in calculating the balance. Even though the check may still be outstanding, it still represents an obligation against your funds, and has therefore been deducted from your balance.

Outstanding Checks

This is a physical count of the number of checks which are still outstanding, as defined in the previous paragraph.

GL Defaults

When transactions are created that involve the bank, they will draw from one of the displayed default values, and place them in the proper fields automatically. Of course you can change them at the application level. Enter the default numbers ( the ones most likely to be used for each process ) for both Debit and Credit, using the data from your own GL setup.