The federal tax guidelines are pre-loaded when you receive your software. They may be updated on a yearly basis in accordance with the guidelines, printed in Schedule E, The Federal Tax Guide for Employers.

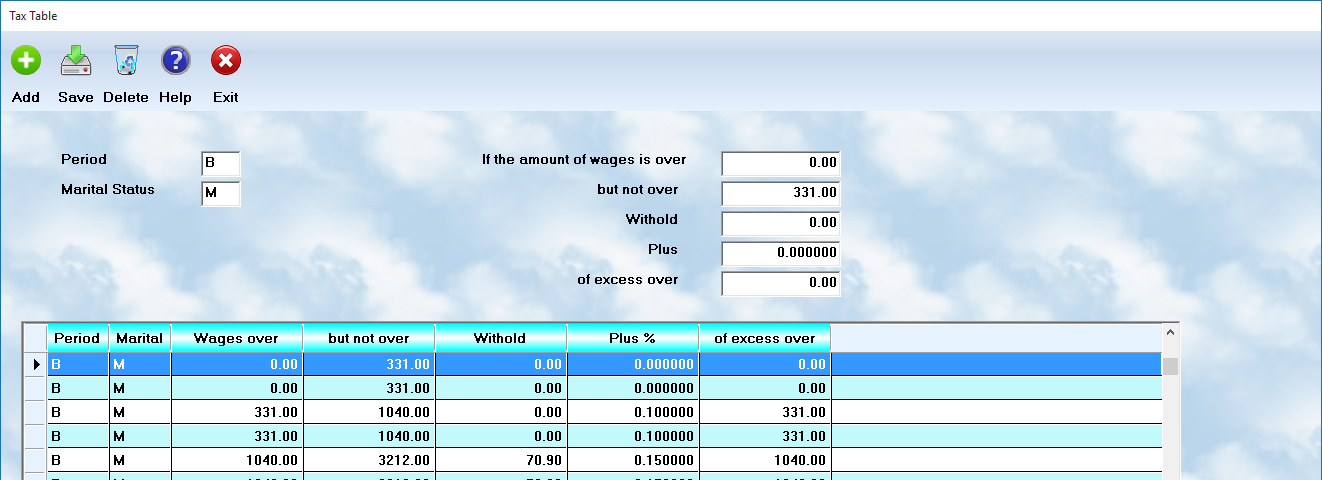

From the Employees - Utilities - Federal Tables option on the main menu the system will display a table that is identical to that found on the federal level. If values need to be changed (for a new year), simply highlight the entry where the corrections must be made. Make your changes, and select the {button Save, } button to retain the modified values.

All tax tables need to be updated each year. If the tax tables are not accurate, the calculations will be inaccurate and you may be responsible for underpayment and consequent penalties.

This table is identical to the charts in the Schedule E. You have the options for Period of Weekly ( 52 payments per year ), Bi-Weekly (every two weeks which is 26 payments per year), Semi-Monthly ( twice a month for 24 payments per year ), or Monthly ( 12 payments per year ). For Marital Status, use Head of Household, Single, or Married. The values to enter are taken directly from the table in the tax guide.

MasterLink Software provides an updated table on its website for downloading. However, it is your responsibility to be sure the newly installed table is correct.