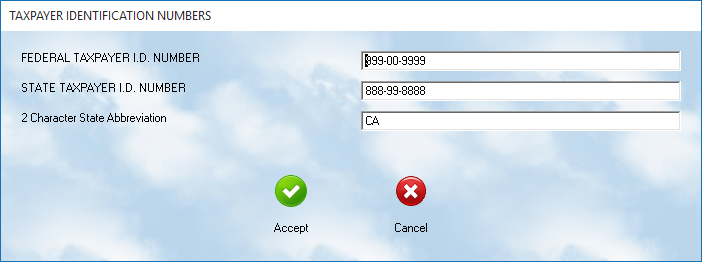

Taxpayer ID Numbers

The federal and state taxpayer ID numbers are required on many reports and forms. Once this option is selected, you may view, and then edit, each number. Be sure that the entries are correct. This screen is also used for the state identification. Enter the standard two letter designator for the state table to be used, ie. CA for California.

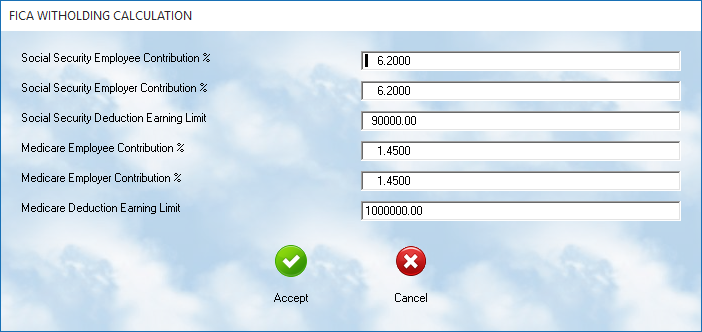

F.I.C.A.

When FICA is selected, the system will display two sets of boxes. Each permits the entry of the employee, and employer, percentage of contribution, and the earnings limit for deductions. The left column of boxes is for social security, while the right set is for medicare. Please note that these rates are different.

The system is set for the year when the software is first shipped. Updates to the files may be made by the operator, in accordance with Schedule E of the Federal Tax Guidelines.

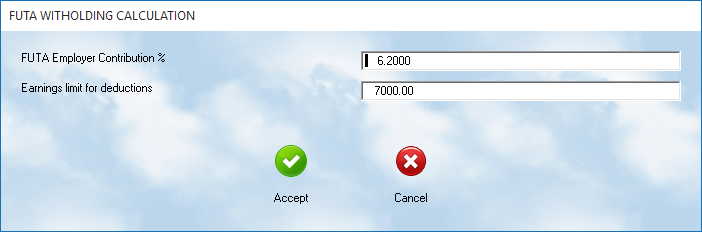

F.U.T.A.

At the present time, FUTA is paid by the employer. The system will display current values for the percentage of contribution, and the earnings limit. These may be updated by the operator at the beginning of each year in accordance with the values in Circular E, the Federal Employer's Tax Guide.

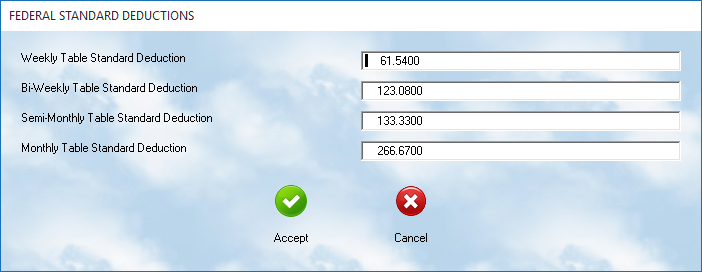

Federal Standard Deductions

The standard deduction is the amount subtracted from gross earnings of an employee for their pay period, prior to calculating the tax liability. The amounts are found in the Circular E, titled Percentage Method Income Tax Withholding Table.

The fields displayed on the screen ask for payroll periods which are weekly, bi-weekly, semi-monthly, or monthly. Enter the amount which is found in that table, which is the amount for each withholding allowance. The system multiplies this amount by the number of federal deductions for the employee, and then subtracts the result from the gross pay, to arrive at a taxable obligation.