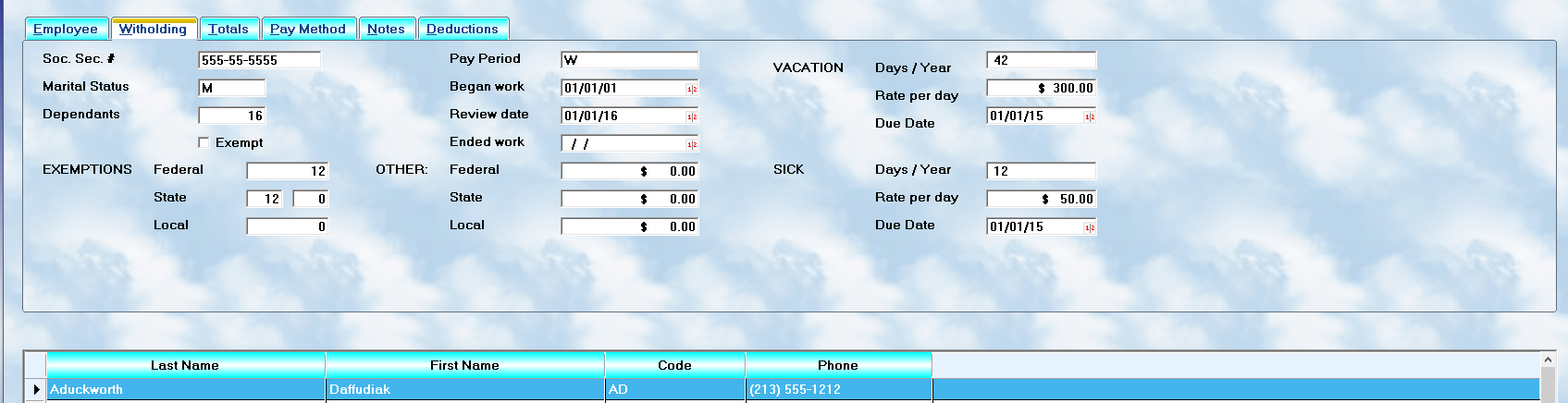

To view the withholding information, first highlight the desired employee, and then select the second folder tab.

It is crucial to maintain the taxpayer information on your employees. The following data is collected:

Social Security Number

The social security number must be on file. It is entered in the first field. All employees must have an SSN.

Marital Status

Your payroll system calculates deductions based on the marital status of each individual to select the proper deduction table. For those who are single, including head of household, enter S. For those who are married enter M. The federal government only utilizes these two categories for withholding, although individuals may file their returns under another status. The field must not be left blank, or processing will revert to single status.

Dependants

The system also asks for the number of dependents. This should reflect the number of actual dependents, not the deduction amount calculated.

Exemptions

The exemptions are calculated on the federal W4 form. Enter the result in the federal field. The state and local exemptions will have up to 2 fields. For example, some states divide the national exemption number into dependents, and allowances for itemized deductions. The amounts may differ. Therefore, they are setup differently. In such a case, enter the dependents allowance in the first field, and the additional deductions in the second field.

Additional Withholding

Some individuals seek additional withholding because it provides for covering the tax liability of a spouse, or other income. The amounts may be specified for federal, state, and local withholding. This will be deducted each pay period.

*** HINT *** Some people will want to withhold extra money only for a short period of time. This amount can be set prior to a payroll processing, and then reset to 0.00. It will not create any problems in calculation, or the maintained totals.

Pay Period

Each individual must be assigned to a payroll processing period. The codes used by the system are:

• W - Weekly

• B - Bi-Weekly

• S - Semi-Monthly

• M - Monthly

It is necessary to enter one of these codes, because they are used to select the appropriate tax table for processing, and those without a period will not be processed at all.

Begin / End Work

It is important to track the hire, and termination, date of an employee. In addition, it is also good to have a review date. These are defined as follows:

•Begin - Enter the date when the employee was first hired. If the employee has worked for varied intervals for your company, you will need to decide if you wish to use the most recent hire date, or the first date of employment.

•End - If an employee is still tracked in the system, but has been terminated, enter the last date of employment in this field. Otherwise, leave the field blank.

Review Date

Employees should all have periodic review dates for performance review, and possible pay increases. Enter the date of the next review in this field.

Vacation

The system will calculate, and track, vacation pay due to an employee. It is necessary to set up the basis, by entering the following three items.

• Days/Year - Enter the number of days of paid vacation that will be earned each year.

• Rate per Day - Enter the amount to be paid for each day of vacation taken. The system will provide this number as a default, but will allow the user to change the amount when calculating the actual pay amount.

• Due Date - Enter the date when the total number of days will be earned. This will usually be the one year anniversary of the employee's hiring.

Sick Pay

The system will calculate, and track, sick pay due to an employee. It is necessary to set up the basis, by entering the following three items.

• Days/Year - Enter the number of days of sick pay that will be earned each year.

• Rate per Day - Enter the amount to be paid for each day of sick leave taken. The system will provide this number as a default, but will allow the user to change the amount when calculating the actual pay amount.

• Due Date - Enter the date when the total number of days will be earned. This will usually be the one year anniversary of the employee's hiring.