State tables are not as consistent as federal, and do not often conform to the same standard. Therefore, there is some flexibility in which the system will prompt for deductions in each state. They are outlined in the following paragraphs.

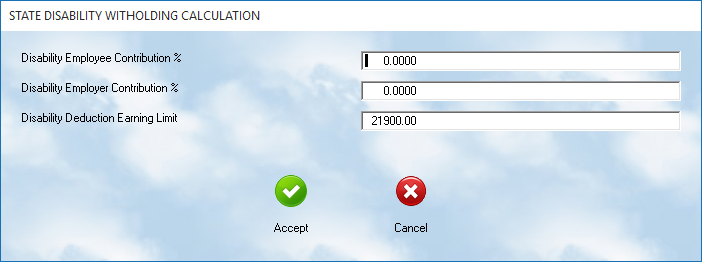

S.D.I.

State disability insurance withholding varies from one state to another. Enter the employee and employer contribution percentages in the spaces provided. If there is an earning ceiling, it may be entered in the third box, as prompted. Be sure to check the state regulations.

Some states have rates which may effectively reduce the FUTA, and require a change. Your state guidelines will provide the necessary information for this setup. If the state has no SDI, the rates should be set to 0.00.

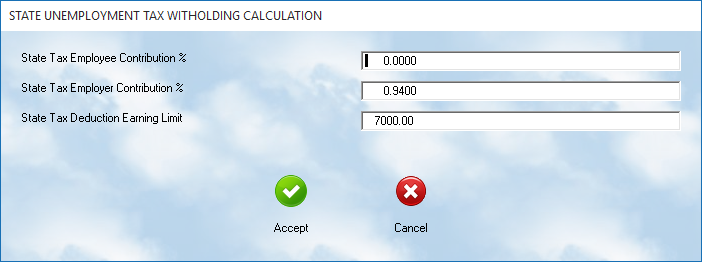

S.U.T.A.

State unemployment insurance withholding varies from one state to another. Enter the employee and employer contribution percentages in the spaces provided. If there is an earning ceiling, it may be entered in the third box, as prompted. Be sure to check the state regulations. Some states have rates which may effectively reduce the FUTA, and require a change. Your state guidelines will provide the necessary information for this setup. If the state has no unemployment tax, the percentage should be set at 0.00.

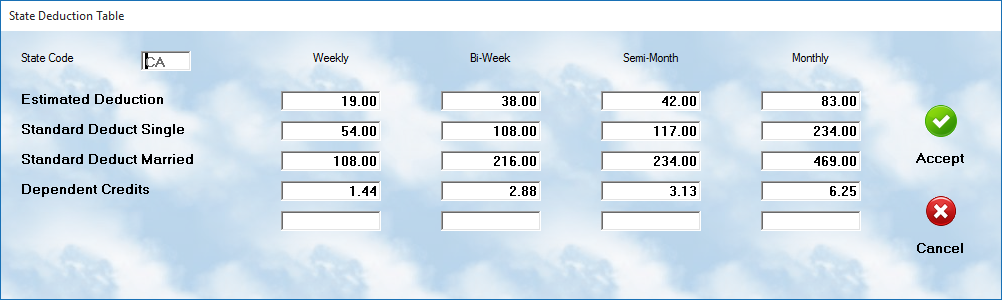

Standard

The standard deductions for the state is divided into three sections. First is the estimated deduction. This is an amount allowed by some states for allowances based on estimated deductions on an itemized return. The standard deduction is the amount allowed for dependents prior to calculating the tax. This is divided into single, and married, allowances. The third amount is the dependent tax credits allowed after the tax obligation has been calculated. If your state does not allow one of these credits, then the value should be set to 0.00. Each section has entries for weekly, bi-weekly, semi-monthly, and monthly.