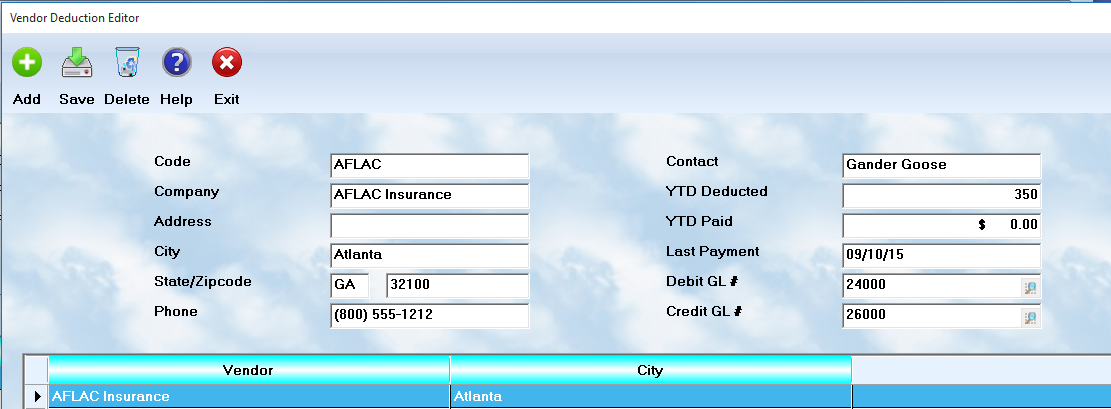

Before setting the individual deductions, you must first establish the vendors from the menu Tools - Company. The following screen is then displayed.

Companies

Each deduction must be tagged to a company or agency to which the amounts will be paid. The company information includes the name, address, and phone number. In addition, the system must know the general ledger debit and credit accounts. The system will track the total amount credited from employees to the deduction, and the actually amount paid out to the vendor from the witheld monies. The following fields need to be completed.

Code

The code is of your creation ... but use one that is easy to remember. Generally 3 letter codes are the best

Company, Address, City, State/Zipcode, Phone

Enter this information which is then added to checks, and available when checking the status of the account.

Contact

Enter the name of your main contact person at this company.

YTD Deducted, YTD Paid, Last Payment

The system will automatically track these items. YTD ( Year To Date ) Deducted is the amount taken from paychecks, and the amount Paid is what you have actually sent to the vendor. The date of Last Payment is updated whenever you process a check

When you withold money from a paycheck for any deductions, either tax or services, it is your responsibility to pay the proper agencies and companies in a "timely manner". The government provides strict guidelines for payments to be posted, and it is wise to use the same policy for your vendor payments. Witheld money is actually the employee's and should be credited to their accounts immediately.

Debit GL #, Credit GL #

Enter the account numbers you want debited and credited when the other deductions are removed from the paycheck. Generally, you will Credit a Liability account and Debit an Expense account. When you actually write a check to make the payment, you will then Credit the bank account and Debit the same Liability account.

Employee

Each employee also requires a deduction record for each item that is to be charged against his payroll. This is performed on the individual employee record as described in the Other Payroll Deduction section of the manual.