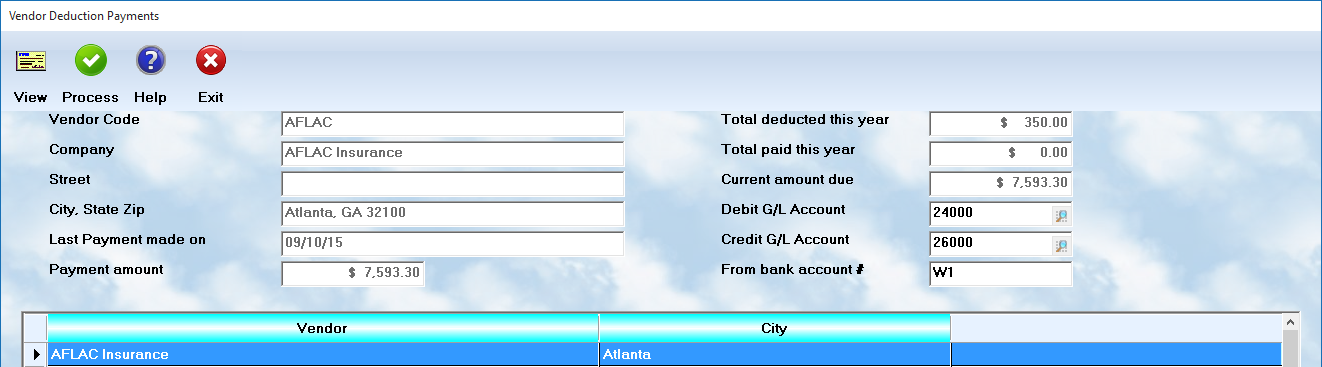

To pay for other deductions, select this option from the Employee Processing menu. You will then see a form with the following information and procedures:

As you highlight each Vendor on the list, you will see the following information provided.

Current transactions

This is a list of companies to whom money is currently owed for obligations related to employee payroll. As you scroll the list, and highlight an individual vendor, full data is provided in the fields above the list.

Vendor information

The system displays information on the vendor, including name, address, amount deducted from employee paychecks for the year, amount paid to the vendor for the year, and the existing balance due. You can also see the G/L account numbers established for transactions with this vendor.

Payment amount

The amount due will show by default. You can change the payment amount if appropriate.

Bank account

This is the bankaccount from which the payment is to be made.

View

Selecting this button will display a check to the vendor for review.

Process

Once you select this button, the system will ask if you wish to process the check. If you say Yes, it will print the check, and complete the accounting tasks.