When the Gross pay option is selected, the system will prompt for the payment period (Weekly, Bi-weekly, Semi-monthly, or Monthly). Then it will determine the proper dates to be included in the processing, and present them for verification. Once correct, the system will then calculate the complete gross pay for each employee, based on their classification, and available pay records.

The system will ask for the hours worked for employees not paid by salary or commission. It will also verify the number of overtime hours worked.

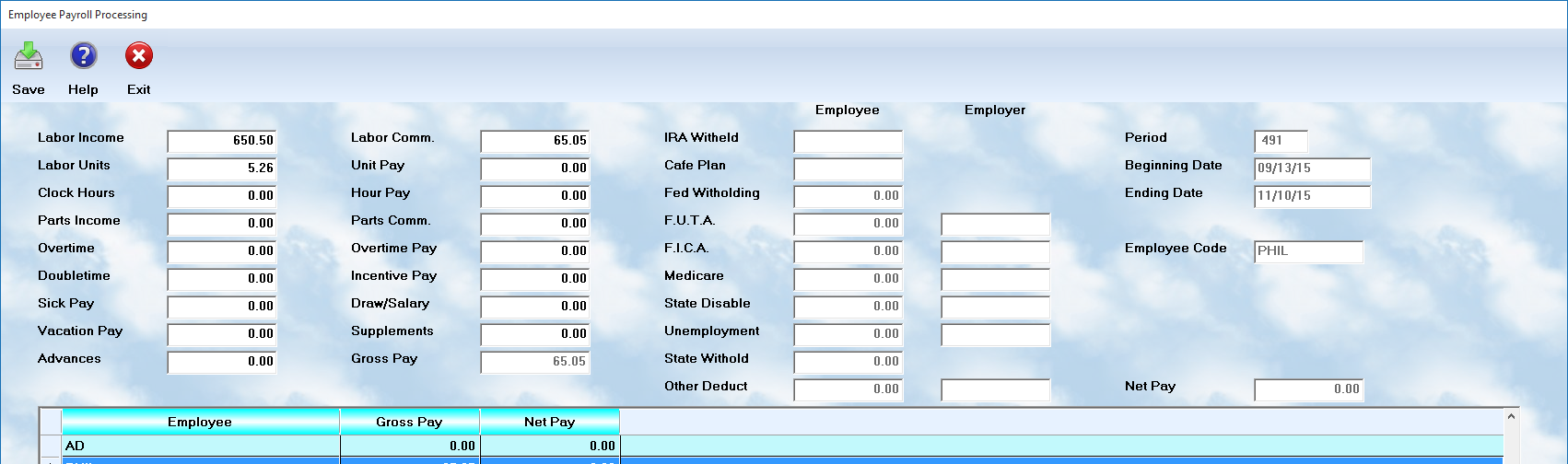

The system will now display a browse lists of employees for whom payroll checks have been created. As you highlight any individual record in the list, the full data will be shown in the fields in the upper part of the screen.

Be sure to review all of the information for accuracy. The totals will be both the actual amounts ( hours, sales, etc ) and calculated amounts. You may edit values that you wish to modify. However, it is suggested that you only add money to the "Supplements" field unless you believe an error has occured in the processing.

The right hand column, which shows deductions, will not display any amounts at this time. The deductions are actually calculated during the next processing procedure.

The following are the categories displayed for editing:

•Labor Income - This is the total the shop charged for labor services by this employee

•Labor Commission - If a commission is paid to the employee for labor, this is the amount.

•Labor Units - These are the total Units ( flat rate hours ) charged during this pay period

•Unit Pay - This is the amount of pay the employee has earned if paid by flat rate

•Clock Hours - This is the total time the employee worked based on the timeclock or manual time entry at processing

•Hour Pay - This is the amount the employee earns from hourly pay

•Parts Income - This is the total of parts sales attributed on workorders to this employee

•Parts Commission - This is the commission to be paid to the employee for parts sales.

•Overtime - This is the total of overtime hours worked by the employee during this period

•Overtime Pay - This is the total pay for Overtime and Doubletime service by the employee

•Doubletime - This is the number of hours worked for doubletime pay during this period.

•Incentive Pay - This is the amount of pay earned if the incentive scale is applied to this employee

•Sick Pay - This is the amount to be paid for sick pay during this period

•Draw / Salary - This is the amount of draw or salary earned during this pay period

•Vacation Pay - This is the amount to be paid the employee for vacation pay on this check

•Supplements - Supplemental pay ( ie. bonuses ) may be entered at this point.

•Advances - This is the amount of advances granted on this check, and it will be deducted from the NET paycheck

•Ira Witheld - This is the amount to be witheld on this check for an IRA account