The methods for paying employees may be quite complex. The Accountant provides a wide range of payment options. Consider each carefully as you study their implementation. You may use one, or any combination, or payment calculation methods with an individual employee. Therefore, very complex payment methods may be created with this system.

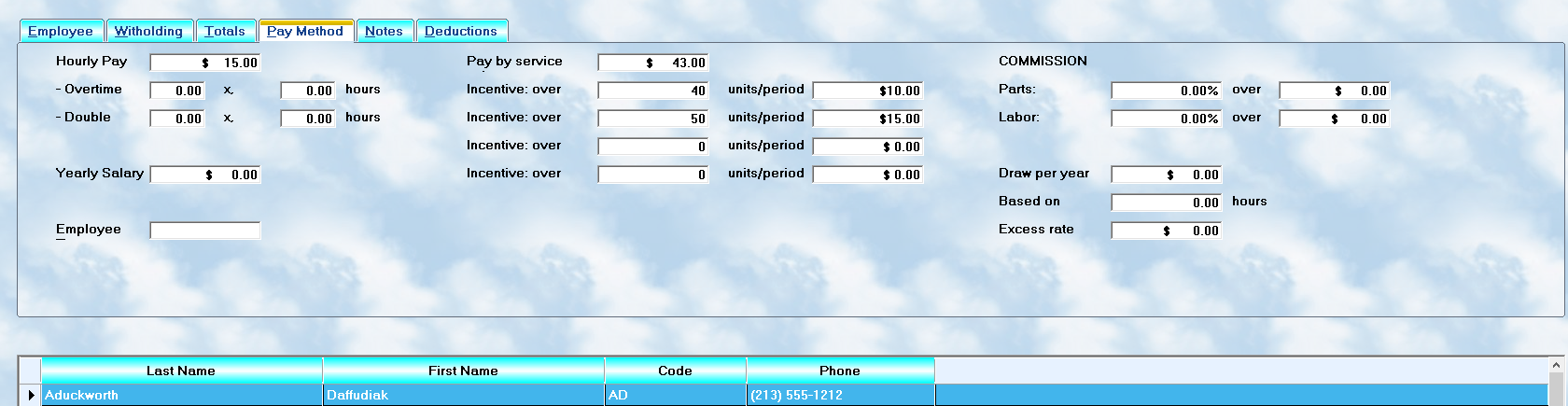

All work is done on the Pay Methods tab option of the Employee-Edit menu selection.

Hourly Pay

Some employees may be paid on an actual time clock basis. Their hourly earnings would be entered in this field (ie. $4.75 per hour). Leave this blank if it is not to be used.

Overtime / Doubletime

It is required by U.S. Federal Law that individuals who work more than 40 hours per week must be paid overtime. The amount is usually 150% of the normal pay rate.

Under certain circumstances, they may be paid a higher amount, usually 200% of normal. This is known as doubletime. These values may be established in accordance with the shop policy.

In the first space, enter the factor ( 1.50 is the standard for overtime ), and in the second field, enter the base hours beyond which overtime is to be paid. These should be established for all employees who are paid on an hourly basis. Do the same for doubletime.

If you do not pay doubletime, be sure to enter the same rate in the field as is used for standard overtime.

Salary

The salary field is used to enter a yearly amount to be paid to the employee. Although this is normally used for owners, or managers, it may also be used in combination with other fields to provide a base salary. For example, a sales representative might earn $12,000 a year salary, plus commission. If paid monthly, this would be a $1,000 base. If they were expected to sell $5,000 worth of product for this amount, and received a commission for sales beyond this amount, they would have a commission set under parts, with a base of $5,000.

Employee Type

There are five employee types handled by the system. This is used for identification, and general ledger assignment. It does not affect the manner in which earnings are calculated.

•M - Management: Shop management is usually paid on a salary or draw. This category includes the owners, and/or executives of the business.

•S - Support: Support personnel would include supervisors, parts managers, and other individuals who do not generate billable labor.

•T - Technical: Technical personnel generate labor which may be billed within the system. This includes technicians, testers, and perhaps supervisors who receive their compensation based on commission for work accomplished.

•C - Clerical: Secretaries, accounting staff, and other clerical personnel are included in this category.

•L - Labor: Casual labor, used as drivers, detailers, and general shop maintenance personnel are within this category.

Commission

A Commission is paid on all parts and labor if amounts are specified. The system will total the parts, and/or labor, for the employee named. If there is a base (amount over which the commission is to be paid), it will be subtracted from the total dollar sales, and become the basis. Then, the percentage entered in the parts and/or labor field will be multiplied by the basis, and applied to the gross earnings Remember that the base, entered in the over field, is the amount to be subtracted from total sales, not from the commission. Also, if no percentage is entered, there will be no amount calculated

for pay.

Pay by Service Units ( Flat Rate )

Many shops pay for labor based on a 'flat rate' method. Using this system, each job has an average amount of billable time on which the charge is based. These units may also be the basis for paying an employee. The rate to be paid, per unit should be entered in this field. For example, if a labor rate book says a job should be worth 1.2 units (loosely interpreted hours), and you pay the technician $20.00 per unit (entered in the unit field), when they are paid, they would receive $24.

Incentive Pay

When employees are paid by units, you may wish to have incentives for completion of a greater number of units within the pay period. For example, if you pay on a weekly basis, and assume that the employee will accomplish 40 units per week, you can reward up to four levels of excess units. The system will first analyze the total units.

Here is a sample chart:

over 40 units/period + $ 1.00/unit

over 50 units/period + $ 1.50/unit

over 60 units/period + $ 2.00/unit

over 70 units/period + $ 2.50/unit

If this employee completes 63 units, he qualifies for 10 units from 41 at $ 1.00 bonus, 10 units at $1.50 bonus, and 3 units at $2.00 bonus. If his base pay is $18.00 per unit, he will earn 40 @ $18.00, 10 @ $19.00, 10 @ $19.50, and 3 @ $20.00 per unit. If the following week he completes 38 units, he reverts to the $18 per unit compensation.

The actual rates, and limits, are decided by the shop based on your policies. To not pay incentives, leave the values at 0.00.

Incentive pay is a good way to improve productivity. However, it is vital to have a policy for handling comebacks. If an employee works so fast that shortcuts are used which should not be, the loss of a client may well result.

Draw per year

If an employee is paid on a draw per year, enter the annual rate in the first field. If this covers only a certain number of hours per pay period, ie. 40 hours per week, enter the number of hours in the period in the second field. If the employee has a base, and is paid for extra hours, enter the hourly pay in the excess hours rate field. Then, the system will calculate an additional amount based on this rate.

Calculation methodology

The system detects which of the four categories your employee qualifies for, and then uses that rate as a basis for supplemental pay. If there are multiple rates, the system calculates the appropriate amount for each category.