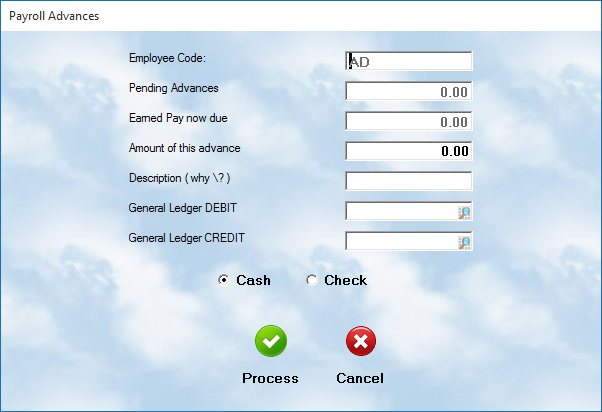

Whenever an employee receives an advance, it must be logged to the system. You can do this in the Payroll Processing menu option for Advance.

A screen will ask for the employee code. Once that is entered, a data entry form is made available to input information regarding the advance.

Pending advance

This is the total of all advances the employee has taken against his pending paycheck. It is important to not let employees overextend their credit.

Earned pay now due

This is the total of Gross pay that employee currently stands to receive on the next paycheck. Remember that taxes will take about 25% of this, and there may be other charges which also cut into the paychecks.

Amount of this advance

Enter the amount you intend to provide with this advance

Description

Enter a brief explanation of why this advance is being provide. A common use of advances is to charge employees for parts they wish to use on their own vehicles.

G/L Debit & Credit

Enter the Debit and Credit numbers for the advance.

Cash / Check

Check the proper method of payment. Cash comes from the daily drawer, and will be reflected on the Drawer Report for the day. Selecting Check will actually allow you to write, and print, a check for the employee.

Advances should be used with great caution. It is not unusual for an employee to "need" advances which exceed current earnings, and then to leave the job, shorting the employer. In addition, some employees constantly need advances, and cannot live from one paycheck to another. This can also be problematic. There is no legal need to provide for advances to an employee.

Processing

Advances are held until the next pay period, at which time they are automatically deducted from the Net earnings of the employee.