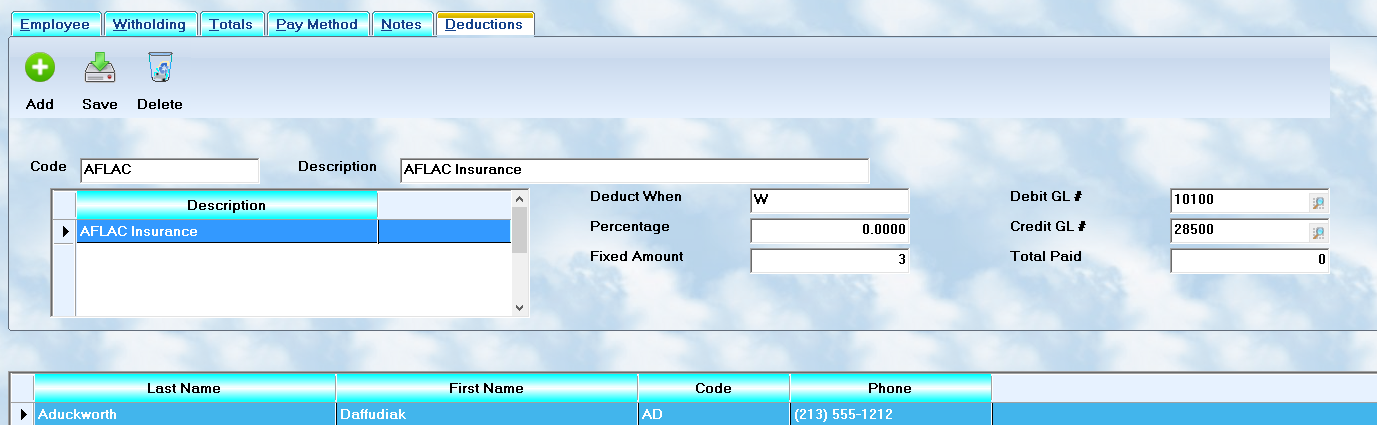

You may create additional deductions for individual employees from the final tab on this screen.

First, you must setup payees ( service providers, insurance companies, etc. ) for these deductions. You do this under the payroll utilities option Company.

To make an employee deduction, it is necessary to select the employee on the browse menu, press the button to start a new deduction record, and then enter the proper code. When you press the Tab key, the other information will be applied by default, but you can modify it as appropriate. Complete the remaining fields as provided:

When

The system needs to know at which point during the processing the deduction needs to be made. Generally, this is on the Gross, or after Federal witholding is withdrawn, or after State witholding is drawn. Enter the proper code from these options:

•Gross - Make the deduction from the Gross pay total

•Federal - Make the deduction from the amount remaining after all Federal taxes have been deducted

•State - Make the decution from the amount remaining after all Federal and State taxes have been deducted

•Keough - Deduct the amount from the Gross pay, calculate taxes on the balance, and then return this amount to the net paycheck.

•Ira - Deduct the amount from the Gross pay, calculate taxes on the balance, and deposit this amount in an Ira account.

On some retirement plans, monies can be witheld prior to any calculations, and then added back to the net of the check after all witholding amounts have been removed. To accomplish this, in the Employee Deduction screen, at the Deduct When ? field, enter the letter K (for Keogh). This amount will be deducted from the Gross Pay prior to processing, and added back to the net pay before writing the check. You may also use I ( for Ira ), in which case the money is NOT added back into the paycheck.

Amount

It is necessary to enter a method for calculating the amount. If it is a percentage of the paycheck ( as determined under When ), enter the value. Otherwise, enter the fixed dollar amount to be deducted. This will be applied at each pay period. If an employee is paid twice per month, and the deduction is for a monthly total, take half out of each pay period.

GL Numbers

•Debit - The GL account to be debited when this deduction is processed in payroll.

•Credit - The GL account to be credited when this deduction is processedin payroll.

Total

The system will also display the total deductions already made for the employee on this account, for this year.