Whenever tax deposits are made to a Federal bank, or the IRS, they need to be logged into the system. When the tax payment is selected, the system will first prompt for a bank account number from which to make the payment, and the date of the transaction.

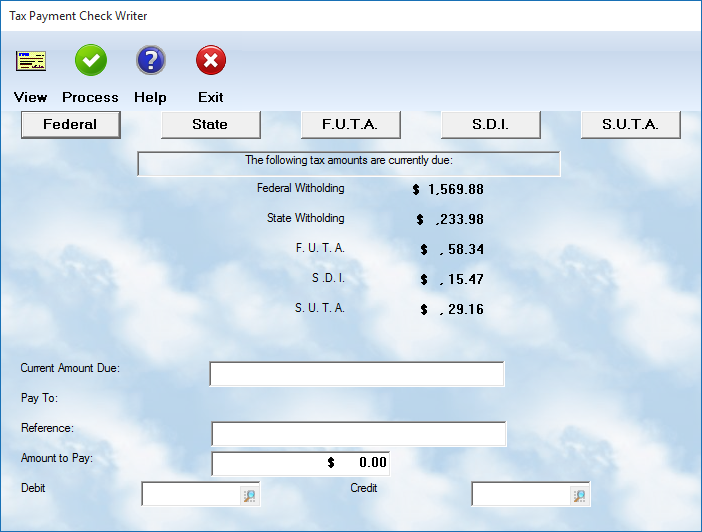

The system will then display a screen for processing your work. The top portion of the screen shows the current obligations owed to each agency.

A series of buttons on the bottom will aid in processing your data. They are:

• Federal - For processing Federal Witholding and FICA

• State - For processing State Witholding

• FUTA - For your Federal FUTA tax

• SDI - For your State Disability Insurance

• SUTA - For your State Unemployment tax

When you select one of these buttons, the appropriate data will show on the form. You can change the amount if appropriate, but normally the system will display only what is actually due, and must be paid.

View

You can view the actual check by selecting this button. It will be in a popup window.

Process

Once you select the OK button, you will be asked if you wish to process the check. If you answer Yes, the system will print the check and handle all of the accounting.

Exit

Press this key when you finish processing all of the checks that are due.

You will be asked "Is this performed by electronic payment ?" If you answer yes, you will be prompted for a payment ID number. If you answer no, then the next check for the account will be used. If you do make an electronic payment, the check number sequence is not affected.